Wealth Portfolio Platform

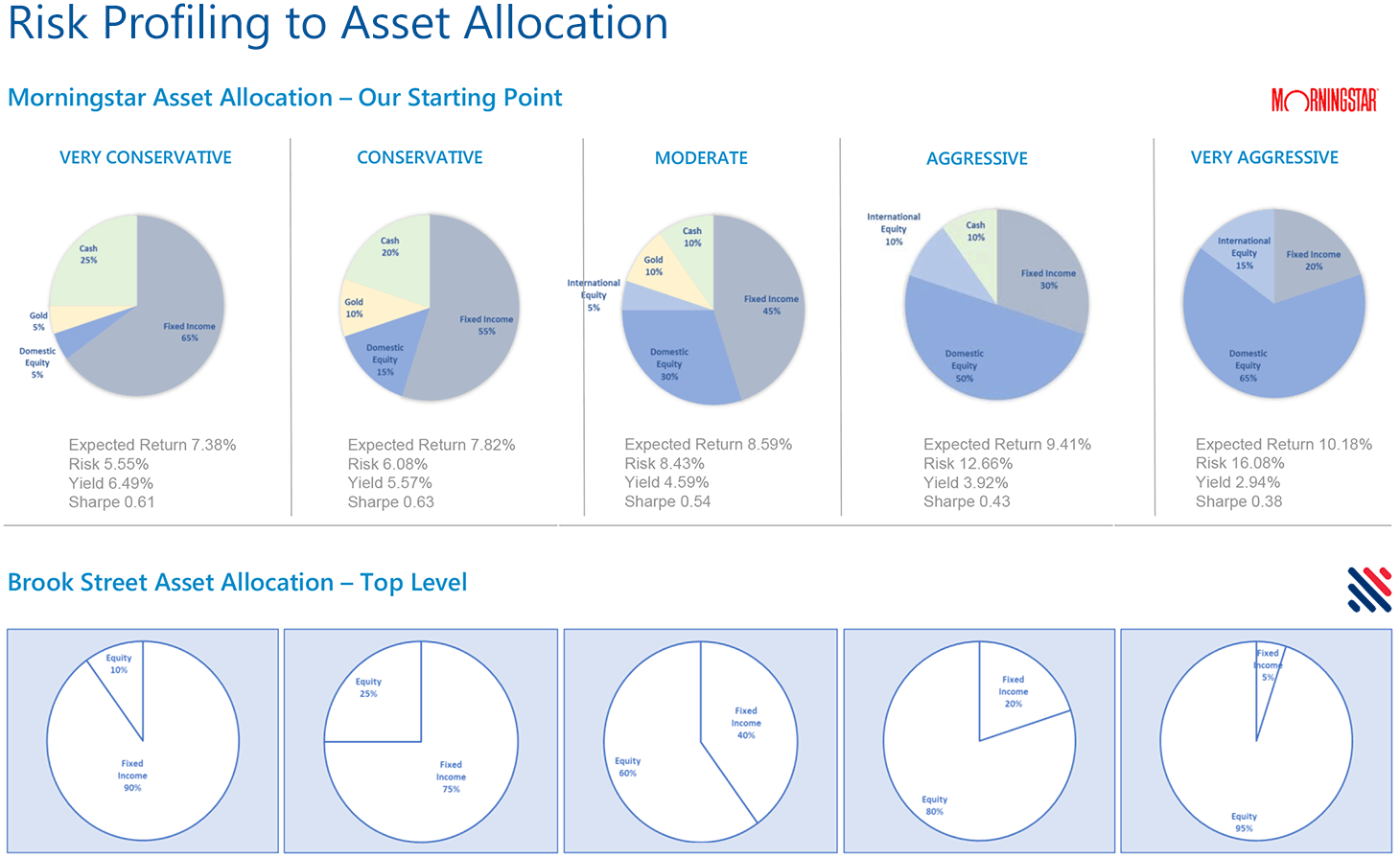

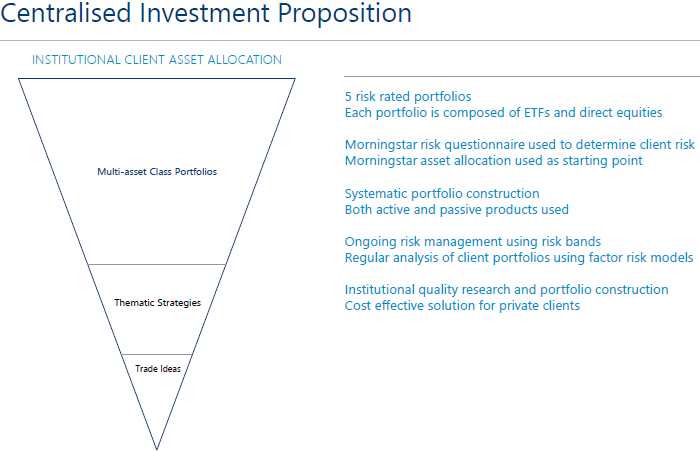

Wealth Portfolio Platform provides investment management services which does all the research and investment strategy leg work and picks the core portfolios and stock ideas for a financial advisor instead of them having to wade through thousands of available products to figure out the right portfolios for their clients. An advisor simply has to determine their client's risk appetite with the Morningstar™ tool we provide, map the risk to the multi-asset class investment strategies on the platform and present the strategies to their clients. The platform also allows advisors to mix and match the strategies or change allocation for the different strategies based on client needs. Here are the different in-house strategies and products that an advisor can access through the platform.

01

Model Portfolio

Strategy

The wealth platform provides a comprehensive range of multi-asset class portfolio strategies with the flexibility to meet any clients' unique life goals. Each of these portfolios are tied to a client's risk attitude ranging from 1 through 5. BrookStreet actively manages these portfolios with risk assessment, portfolio analytics, and rebalancing. Client facing presentations are available for each of these portfolios. Advisors don't have to spend time setting up clients' portfolios or worry about rebalancing, asset location, or risk management. Our investment management team handles all the portfolio management and trading, so that an advisor can spend time where it really matters, with their clients.

02

Thematic

Strategies

The platform offers several thematic portfolios which are equity strategies focused on broader macroeconomic themes. From top brands and disruptive technologies to clean energy and climate change, our investment team identifies top ideas and run significant research, data analytics and testing before these portfolios are made available for the advisors to offer to their clients.

BrookStreet actively manages these portfolios with risk assessment, portfolio analytics, and rebalancing. Client presentations and factsheets are available for all thematic strategies.

03

Custom Multi-Asset

Portfolios

BrookStreet wealth portfolio platform gives advisors the capability to create completely customisable portfolios for their clients above and beyond the pre-determined core portfolios. The advisors can select from a list of top performing stocks within one or multiple industry sectors, and put together a portfolio on the fly. The portfolio will automatically calculate the risk score and map the variance to the client's risk profile. The advisor can further add other asset classes (fixed income, mutual funds, cash, etc.) into the portfolio and make it a multi-asset class portfolio. All top performing stocks listed in the platform are vetted by the BrookStreet investment team through rigorous research, back-testing and drawdown scenarios.

04

Global Diversification

Strategies

BrookStreet through its UK based joint venture partner provides structured investment products for sophisticated investors and high net worth individuals (HNWIs) who understand the benefits of global diversification. Many of these products come with advanced features like capital protection, yield enhancement and hedging of financial risks to enable attractive and efficient savings. Client presentations and factsheets are available on the platform for these global products. There is a minimum investment requirement for some of these products.