Institutional Quality

BrookStreet Wealth brings institutional grade research, investment products, and asset management capabilities to private and business clients in India using techniques that are traditionally available only to large pension funds and sovereign wealth funds, typically with several billion dollars in assets. These asset allocation, stock selection and portfolio construction techniques have been adapted and proven with private clients in Europe and are now being applied in India using stocks, mutual funds, structured products, ETFs and fixed income instruments.

Disciplined, fundamental and research driven

Our financial planning process starts with creating a client risk profile. BrookStreet uses tools such as MorningstarTM to understand our client's financial objectives, attitude towards risk, life stage and investment timeframe. An investment portfolio, usually multi-asset class, is then generated, invested and managed for the client. The portfolio is monitored and rebalanced regularly. Because of our systematic portfolio construction process, we can provide a bespoke core-satellite approach at low levels of investment. This constitutes a core investment strategy along with one or more satellite strategies that could target dividend income or momentum.

Thematic equity strategies and single stock trade ideas

We use proprietary research and analytics techniques to identify investment opportunities in individual stocks across industry sectors. We then create, test and manage unique and dynamic portfolios of companies with exposure to these opportunities so that our clients can invest in them. A theme based investment strategy could be “Brand India”, where we group high performing companies with well recognized consumer brands that touch our daily lives. These portfolios can be accessed at low levels of capital and can be used in isolation or as satellites in a core-satellite approach.

Access overseas investment products

Our clients can diversify their portfolio and get exposure to foreign equities or capital protected financial products traded in the developed markets and backed by some of the largest banks in the world. BrookStreet can offer products tailormade to a client's specific needs. These products are ideal for sophisticated investors who understand the benefits of global diversification or want to plan for a family trust or children's overseas education.

Empower advisors to deliver diversified, risk-managed solutions

Advisors will get access to institutional quality asset management solutions and analytics, ability to create bespoke portfolios for clients, introduce overseas products that include capital protected structured notes and the ability to interact and leverage the European network of established partners active in asset management and financial advisory. Advisors will be able to offer solutions optimised for a broad spectrum of client requirements.

Modern tools, technology, compliance and reporting

Besides financial markets, our primary investment is in relationships. We strive to foster a client-centric culture, where we ensure that we stay focused on client engagement, promote best practices and maintain transparency and integrity. Our clients, advisors and investment managers have access to modern tools and technology including mobile apps and dashboards. We communicate through quarterly market updates and follow strict compliance guidelines.

The BrookStreet Difference

Institutional Grade

Institutional Quality

BrookStreet Wealth brings institutional grade research, investment products, and asset management capabilities to private and business clients in India using techniques that are traditionally available only to large pension funds and sovereign wealth funds, typically with several billion dollars in assets. These asset allocation, stock selection and portfolio construction techniques have been adapted and proven with private clients in Europe and are now being applied in India using stocks, mutual funds, structured products, ETFs and fixed income instruments.

Investment Approach

Disciplined, fundamental and research driven

Our financial planning process starts with creating a client risk profile. BrookStreet uses tools such as MorningstarTM to understand our client’s financial objectives, attitude towards risk, life stage and investment timeframe. An investment portfolio, usually multi-asset class, is then generated, invested and managed for the client. The portfolio is monitored and rebalanced regularly. Because of our systematic portfolio construction process, we can provide a bespoke core-satellite approach at low levels of investment. This constitutes a core investment strategy along with one or more satellite strategies that could target dividend income or momentum.

Innovative Solutions

Thematic equity strategies and single stock trade ideas

We use proprietary research and analytics techniques to identify investment opportunities in individual stocks across industry sectors. We then create, test and manage unique and dynamic portfolios of companies with exposure to these opportunities so that our clients can invest in them. A theme based investment strategy could be “Brand India”, where we group high performing companies with well recognized consumer brands that touch our daily lives. These portfolios can be accessed at low levels of capital and can be used in isolation or as satellites in a core-satellite approach.

Global Products

Access overseas investment products

Our clients can diversify their portfolio and get exposure to foreign equities or capital protected financial products traded in the developed markets and backed by some of the largest banks in the world. BrookStreet can offer products tailormade to a client’s specific needs. These products are ideal for sophisticated investors who understand the benefits of global diversification or want to plan for a family trust or children's overseas education.

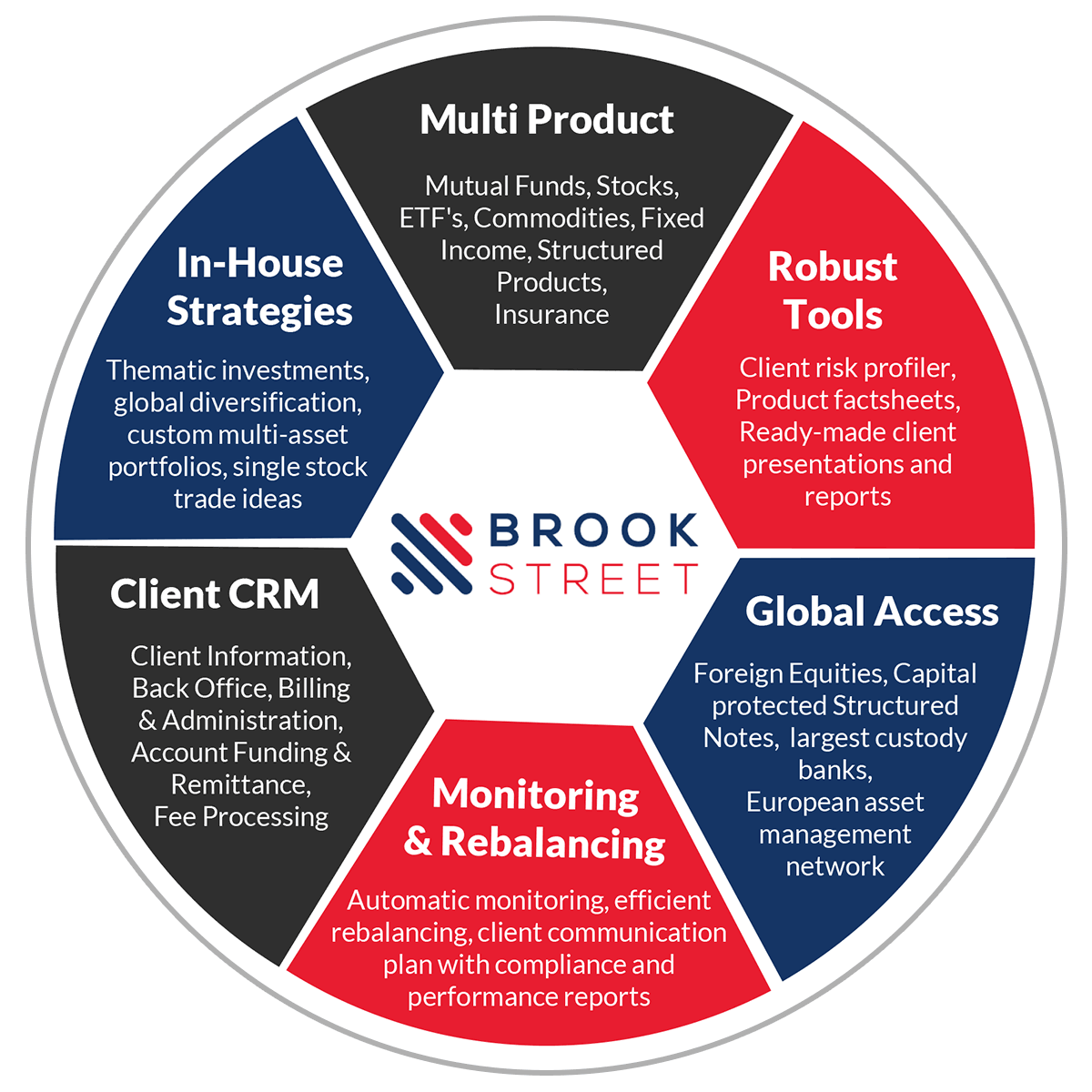

Wealth Portfolio Platform

Empower advisors to deliver diversified, risk-managed solutions

Advisors will get access to institutional quality asset management solutions and analytics, ability to create bespoke portfolios for clients, introduce overseas products that include capital protected structured notes and the ability to interact and leverage the European network of established partners active in asset management and financial advisory. Advisors will be able to offer solutions optimised for a broad spectrum of client requirements.

Client-centric Culture

Modern tools, technology, compliance and reporting

Besides financial markets, our primary investment is in relationships. We strive to foster a client-centric culture, where we ensure that we stay focused on client engagement, promote best practices and maintain transparency and integrity. Our clients, advisors and investment managers have access to modern tools and technology including mobile apps and dashboards. We communicate through quarterly market updates and follow strict compliance guidelines.

Our Clients

Building rewarding long-term relationships with clients is based on honesty, reliability, customer service and, of course, competence.

Private Clients

Services

BrookStreet provides wealth management, bespoke financial planning, and advisory services along with cash flow planning and optimisation to help our clients' plan their financial future. Our expertise lies in managing equity portfolios, thematic portfolios and multi-asset class portfolio suites. We have extensive investment management experience and access to the latest research and a cutting edge in-house analytics platform. Our primary goal is to protect and grow our clients' capital.

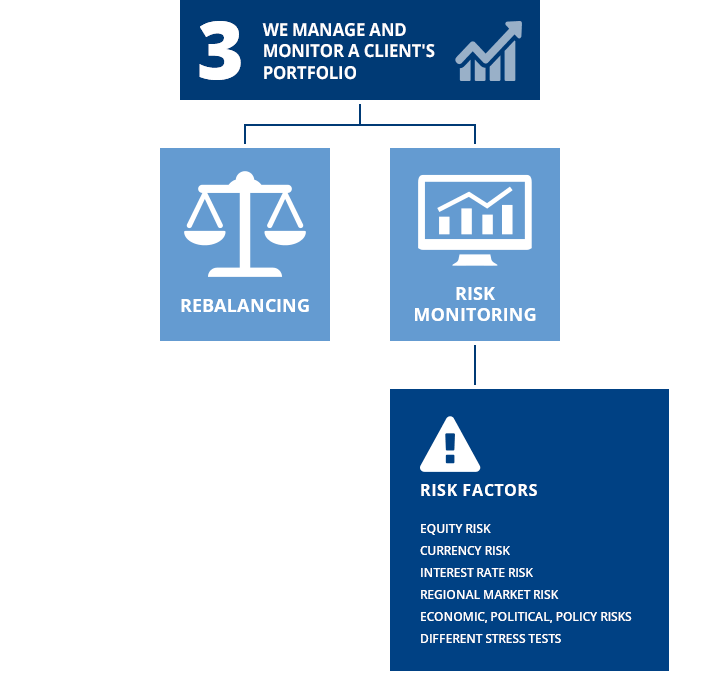

Portfolio Structuring and Risk Management

We build risk targeted multi-asset class portfolios diversified across Indian or global markets giving our clients access to all major asset classes, covering stocks, bonds, mutual funds, and more. After we conduct a client fact find exercise, we build a risk compliant custom portfolio. We actively monitor the risk parameters and when our investment model approaches a regular rebalance cycle or anticipates a breach in risk tolerance, we rebalance the holdings. The result is a portfolio that follows a client’s risk profile closely.

Access to Thematic Portfolios

We apply data analytics to uncover important trends driving the economy and identify unique investment opportunities. Then we create dynamic portfolios of companies with exposure to these trends so that our clients can easily invest in them. This is referred to as thematic investments and frequently used in satellite portfolios or as tactical investments. For example, a theme could be a portfolio of top Indian consumer brands or companies that are enabling digital India or the top ten profitable companies in India.

Lower Management Fees and Taxes

Management fees and other charges deducted from invested assets compound over time and can significantly reduce a client’s return. Our goal is to reduce these fees over a period of time by creating a cost effective portfolio comprising of funds, ETFs and direct equity. If a client’s goal is tax reduction through different investment schemes, we can help plan those strategic investments to lower the tax obligations.

Global Investments and Advanced Market Products

Government of India's Liberalised Remittance Scheme allows all resident Indians, including minors, to freely remit up to USD 250,000 per financial year for any permissible current or capital account transaction or both. Sophisticated investors understand the benefits of global diversification, the risks of home market bias and concentration. Investing in companies in both developed and developing economies outside India is an effective strategy for balancing risk and reward. BrookStreet provides access to multi-currency based diversified global portfolios, capital protected products and beneficial tax regime through its joint venture partner.

Invest in India's Growth Story

India is poised to become the fifth largest economy in the world and the second largest in Asia. India's growth story coupled with a well-established and regulated securities market make India a unique investment opportunity and many foreign investors want India exposure in their portfolios. BrookStreet assists European family offices, international investors (FPI) and Non-Resident Indians with India focused asset allocation strategies and portfolio investment schemes.

Institutional Clients

Services

BrookStreet provides advisory and discretionary fund management services to institutional clients. We construct and manage a variety of equity and multi-asset class portfolios for bespoke mandates. Our asset management background is institutional, our skill-set developed at some of the biggest financial centres in the world. Our research is fundamental, our approach is systematic and technology-driven, making the investment process consistent, efficient and transparent. Our goal is to provide institutions with robust solutions using fundamental research and innovative quantitative techniques.

The process

For institutional clients, our process begins with a clear understanding of the mandate that defines the overall investment purpose, high-level guidance on balancing risk and return objectives, the approximate time horizon for investments and finally the policy around performance management and governance. Based on the mandate, we prepare an investment strategy where investment objectives, risk tolerance, restrictions on positions and other constraints are established, and benchmarks are defined for measurement and comparison against the portfolio.

Risk Management

Once a strategy is executed, risk analysis and monitoring becomes a critical component of the investment process. Apart from risk measures such as Value at Risk (VaR), we use fundamental and statistical risk models to monitor risk and return of industry, country, and style factors such as momentum and value.

Wealth Advisors

The BrookStreet Wealth Wealth Portfolio Platform is unique and addresses some of the challenges that today's financial advisors face.

Challenge #1: Discovering Efficiency

An independent financial advisor spends significant time on:

Challenge #2: Finding Right Products

Majority of financial platforms available to financial advisors:

Challenge #3: Retaining Clients

Ideally financial advisors should put more time and effort on client centric activities:

Wealth Portfolio Platform

The BrookStreet wealth portfolio portal allows advisors to spend more time with clients, and grow their business while investment managers work in the back-end, offering institutional quality investment advice. Advisors get access to bespoke products designed to facilitate highly customised risk-return objectives, and integrated reporting. BrookStreet's wealth portfolio platform is unique because it combines technology with investment management services, not easily available across the Indian financial advisory spectrum.

The wealth platform is ideal for advisors and wealth managers who want to adopt a goal and risk based investment advisory process to ensure improved outcomes for both them and their clients’ unique needs. Advisors seeking to offer products, based on client risk appetite, can use the platform to offer risk rated core portfolios, satellite strategies and single stock ideas.

Team

BrookStreet Wealth provides bespoke financial planning, wealth management and advisory services to thousands of clients throughout India and abroad through its physical office in Kolkata, India. BrookStreet through its international partnerships, also brings strong global asset management capabilities to India and extensive experience in managing billions of dollars in institutional and private capital pool across developed markets.

It has extensive wealth management experience, access to the latest academic research and a cutting edge in-house analytics platform. We have the expertise and resources to provide comprehensive and personalized solutions to help you reach your goals. No matter where you are in life, our advisors are dedicated to helping you enhance and preserve your financial future.

Our investment management, research, portfolio management and advisory services teams have worked in senior management positions at top financial institutions like Morgan Stanley, Credit Suisse, Karvy, L&T Financial Services and others.

Contact Us

Are you interested in exploring new ideas and ways to manage your wealth? Don't hesitate to get in touch with us!

BrookStreet Wealth Pvt Ltd.

73 Ballygunge Place

Kolkata 700019

India

Phone:

+91 98364 45454

Email:

info@brookstreet.in